malaysian working overseas income tax

While Budget 2022 had announced that foreign sourced income will be taxed the government has decided to continue the tax exemption from year of assessment 2022 until 2026. 1421 Indian car makers propose tax cut on imports in trade deal with Britain.

Foreign Sourced Income Received From Outside Malaysia Tax Planning For Residents Youtube

You must be certified by the relevant agency in Malaysia.

. 2020-2-9Overseas Filipino workers OFWs are exempted from paying the terminal fee. 2 days agoOverseas Study D-2 visa. While 30 US dollars need to be paid while submitting the application the remaining 30 US dollars is required to be paid when the work pass or permit is issued to the individual by the authorities.

Malaysia business and financial market news. Youll also need a Certificate of Good Conduct from your country of originYou can get this from the. 2 days agoSingapore ˈ s ɪ ŋ ɡ ə p ɔːr officially the Republic of Singapore is a sovereign island country and city-state in maritime Southeast AsiaIt lies about one degree of latitude 137 kilometres or 85 miles north of the equator off the southern tip of the Malay Peninsula bordering the Strait of Malacca to the west the Singapore Strait to the south the South China Sea to the.

The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. Income tax exemption equivalent to a rate of 60 to 100 of QCE incurred to be utilised against 100 of statutory income and within a period as determined by the Minister applications received by 31 December 2022. Youll need to obtain recommendation from a relevant agency in Malaysia.

Singapore Work Visa Fees. Overseas Networks Expertise Pass. 2022-8-25Consider your health care plans income sources and tax bracket before making the transition.

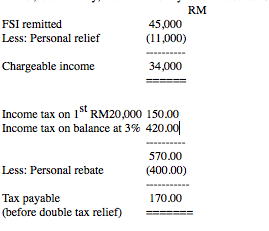

2022-10-22Foreign income tax has been paid on the income in the foreign jurisdiction from which the income is derived. 2 days agoLegal framework Non-resident Indian NRI Strictly asserting the term says non-resident refers only to the tax status of a citizen who as per section 6 of The Income-tax Act 1961 has not resided in India for a specified period for the purposes of the Income Tax Act. 2022-3-14This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country.

2 days agoThe Nations Leading Newspaper. For Malaysian confinement nannies to work in Singapore for up to 16 weeks starting from the birth of the employers child. Vijays first salary as a.

Affected registered business enterprises RBEs in the IT-business process management IT-BPM sector that intend to transfer registration from the Philippine Economic Zone Authority PEZA to the Board of Investments BOIDepartment of Trade and Industry DTI to adopt 100 percent work from home WFH arrangement without. 1250 Strongly contest sovereign credit ratings downgrade by Moodys. The terminal fee ranges from P50 to P220 per person for domestic flights or P600 to P1135 per person for international flights.

46 per month Dinner Out at Midrange Restaurant. 2022-6-13Income tax exemption at a rate of 70 to 100 for a period as determined by the Minister applications received by 31 December 2022. For top talent in business arts and culture sports science and technology and academia and research.

Due to the high cost of education and difficulty in attracting foreign students the government considered granting special work visas to parents of students on D-2 visas in 2006. He also performed as child actor in Naan Sigappu Manithan 1985 co-starring Rajinikanth as lead actor. 38 three courses two people Movie Ticket.

The Overseas Study D-2 visa is issued to a foreigner who are planning to study at the undergraduate or above level of school. There is Singapore tax payable on the income. To be endorsed as income tax exempt your charity must meet certain requirements.

For foreign performers working in public entertainment outlets such as. The Philippine travel tax is a fee for Filipinos traveling abroad. Geoff Williams July 23 2019 13 Frequently Asked Retirement Questions.

1 day agoWatch CBS News live and get the latest breaking news headlines of the day for national news and world news today. Deductible gift recipient test. 1143 Thailand mourns children other victims slain by ex-police officer.

2022-10-24News and opinion from The Times The Sunday Times. Get all the latest India news ipo bse business news commodity only on Moneycontrol. What is PH Travel Tax.

1122 N Korea draws up guidelines for emergency health crisis natural disasters. 491 per month Rent for a Three-Bedroom Outside City Center. The highest Corporate Income Tax rate headline tax rate of the foreign jurisdiction from which the income is derived is at least 15 at the time the foreign income is received in Singapore.

Our services are here to provide you with legitimate academic writing help to assist you in learning to. 2 days agoPolitical corruption is the use of powers by government officials or their network contacts for illegitimate private gain. 63 per month Internet.

Rent for a One-Bedroom in City Center. 619 per month Utilities Electricity Heating Cooling Water Garbage. 2 days agoAt the age of 10 Vijay started his film career as a child actor in the film Vetri 1984 and then performed as child actor in films such as Kudumbam 1984 Vasantha Raagam 1986 Sattam Oru Vilayaattu 1987 and Ithu Engal Neethi 1988.

Turning to course help online for help is legal. The rates of income tax are different for persons who are resident in India and for NRIs. Getting assignment help is ethical as we do not affect nor harm the level of knowledge you are expected to attain as a student according to your class syllabus.

573 per adult Cost of a New Volkswagen Golf. Public Bank and Public Islamic Bank To Increase Its Loan Financing Reference Rates By 025 Public Bank will increase its Standardised Base Rate SBR Base Rate BR and Base Lending Rate BLR Base Financing Rate BFR by 025 effective 12 September 2022 in line with Bank Negara Malaysias Overnight Policy Rate OPR hike by 25 basis points from 225 to 250 on. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Working with us is legal. The fees payable for availing a Singapore Work Visa or Work Pass is as of now 60 US dollars. Your charity is entitled to be endorsed for income tax exemption if it.

Prescribed by law test meets both of the following conditions Governing rules condition. Forms of corruption vary but can include bribery lobbying extortion cronyism nepotism parochialism patronage influence peddling graft and embezzlementCorruption may facilitate criminal enterprise such as drug trafficking money. 2021-7-30For this method the Immigration Department of Malaysia states that you must be a professional with outstanding skills in any field.

Meets at least one of three tests.

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

Determining China Income Tax Liability For Expats Covid 19 Travel Ban

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Guide For Expats In Malaysia Expatgo

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Putting The Malaysian Diaspora Into Perspective

Malaysia Tax Exemption On Foreign Sourced Income Rodl Partner

Tax Exemption On Income From Foreign Sources Until 2026 Free Malaysia Today Fmt

Taxing Of Foreign Source Income Keep It Simple Please Businesstoday

Personal Income Tax Guide For Expatriates Working In Malaysia 2022

Individual Income Tax In Malaysia For Expatriates

How Will Malaysia S Foreign Sourced Income Tax Affect Your Business Event Hsbc Visiongo

Malaysian Tax Issues For Expats Activpayroll

Putting The Malaysian Diaspora Into Perspective

Tax Implications For Malaysians With Foreign Bank Accounts And Foreign Source Income In Overseas Cheng Co Group

8 Countries With Zero Foreign Income Tax

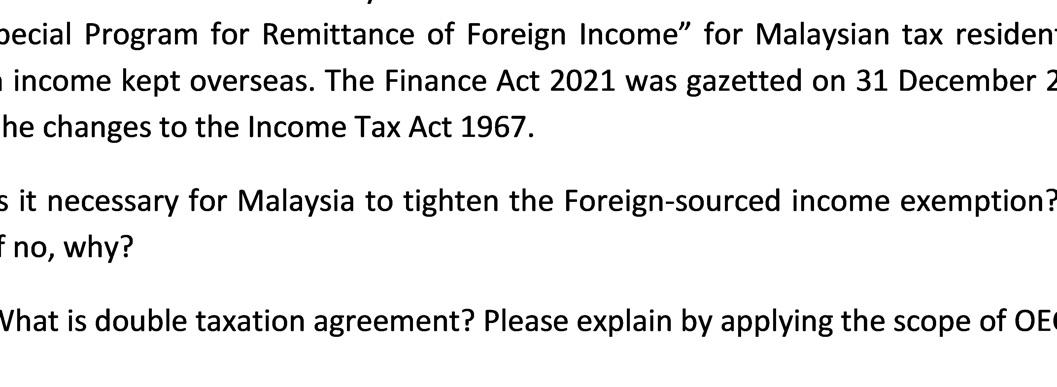

Ecial Program For Remittance Of Foreign Income For Chegg Com

Comments

Post a Comment